菜单

Panjiva is an intelligence platform that’s bringing transparency to global trade through our robust global coverage, powerful machine-learning technologies, and dynamic data visualizations. Whether you’re looking to identify potential business partners, keep track of competitors, or find investment signals, our platform arms you with unrivaled insights to make supply chain decisions with conviction. Learn more

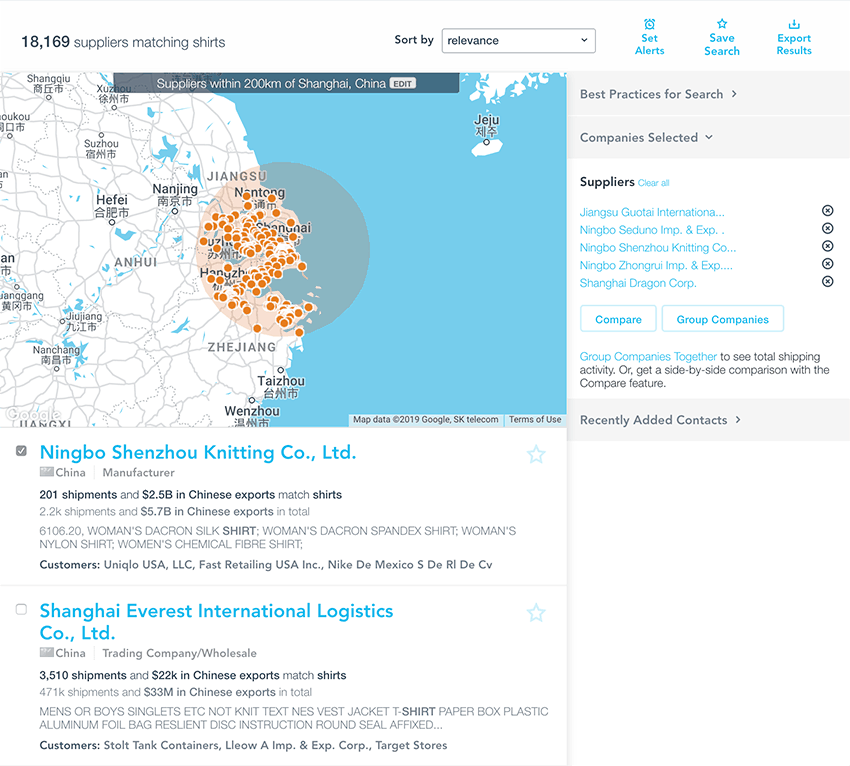

我们平台采用 机器学习和 数据可视化技术,为您呈现出与国际贸易密切相关地非常清晰且极具操作性的解析。

Our technology gives you immediate insight into the companies involved at every node of international supply chains. From manufacturers and buyers to shipping and logistics, Panjiva allows customers to better understand trade around the globe.

需要给您的销售团队建立一个潜在客户名单?您可以轻易地导出您想要的结果,然后分享给您的团队让他们去和客户联系。

无论您是想通过产品名字还是产品类别搜索产品,我们能让您很容易的做到。您可以通过商品名字、HS/HTS编码、邓白氏编码和地区进行搜索。

保存您的搜索,当一家符合您搜索条件的新公司出现时,或现有的公司有了新的货运动态时,您随时都能收到邮件提醒。

通过查看您竞争对手采购产品的区域及货物装运涉及到的企业了解您的市场份额。

使用我们平台 来分析贸易航线或识别哪些公司有最具风险的供应链。

无论您是在锁定采购商、还是供应商,抑或无船承运人,或是承运人,磐聚网可助您轻松地确认最好的销售前景,助您更多地了解他们的业务,从而与之取得联系。

Use Xpressfeed™ to push leads directly into your CRM system or feed data about publicly-traded companies into your quant models.

March 15, 2022

Panjiva said that when accounting for February having fewer days, imports headed up to 90,315 TEU per day, topping January’s 86,363 TEU per day, which marks a record TEU per day tally, for the month of February, despite the impact of the Lunar New Year in Asia.

February 20, 2023

Key findings this week: Ford’s electric vehicle supply chain is expanding rapidly but faces operational and sourcing challenges. The consumer goods industry, particularly the toys industry, has an inventory problem and trade activity has fallen as a result. Foxconn is the latest electronics...

More research articles